Running a growing business is exciting — but behind every successful venture lies one constant: strong financial control.

Many founders focus on sales, operations, and marketing, while their accounts quietly accumulate issues that later explode into compliance problems, cash shortages, or tax disputes.

Even if your accounting is outsourced or handled by an in-house team, as a founder, you must know what warning signs to look for.

Ignoring them can lead to wrong business decisions, penalties, or even financial losses.

Let’s uncover the five major red flags that every founder should keep an eye on — and how to fix them before they turn into serious problems.

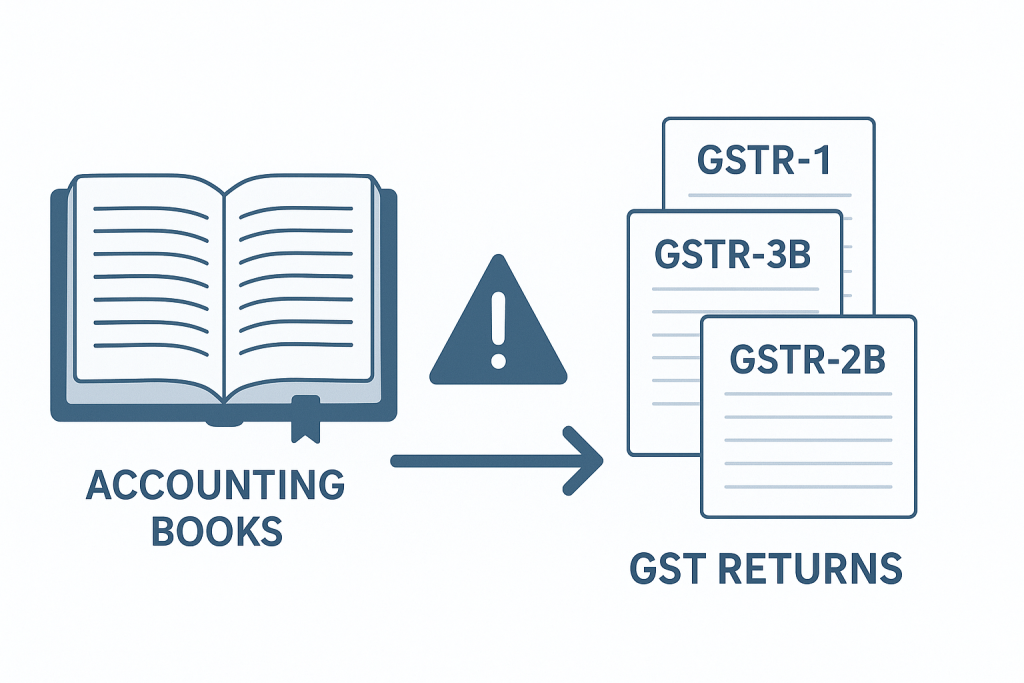

1. Mismatch Between Books and GST Returns

One of the most common (and dangerous) red flags is when your accounting books don’t match your GST returns — especially GSTR-1, GSTR-3B, and GSTR-2A/2B.

Why This Happens:

- Sales invoices are recorded in books but missed in GSTR-1 filing.

- Credit notes or amendments are not reconciled properly.

- Purchases are claimed in books but missing in GSTR-2B because the supplier hasn’t filed returns.

- Round-off differences or manual adjustments not reflected in both systems.

Why It Matters:

A mismatch between GST data and books can trigger:

- GST notices like ASMT-10 or DRC-01.

- Disallowance of Input Tax Credit (ITC).

- Interest and penalty under Section 74A (previously 73/74).

- Discrepancies in turnover reported in ITR vs. GST vs. financial statements.

How to Fix:

- Conduct monthly reconciliation between GSTR-1, GSTR-3B, and accounting books.

- Verify supplier compliance using GSTR-2B before availing ITC.

- Use automated reconciliation tools if your business has high transaction volume.

- Assign responsibility to a specific team member or your CFO partner for regular review.

A proactive reconciliation approach can save you from painful tax notices later. GST reconciliation guide.

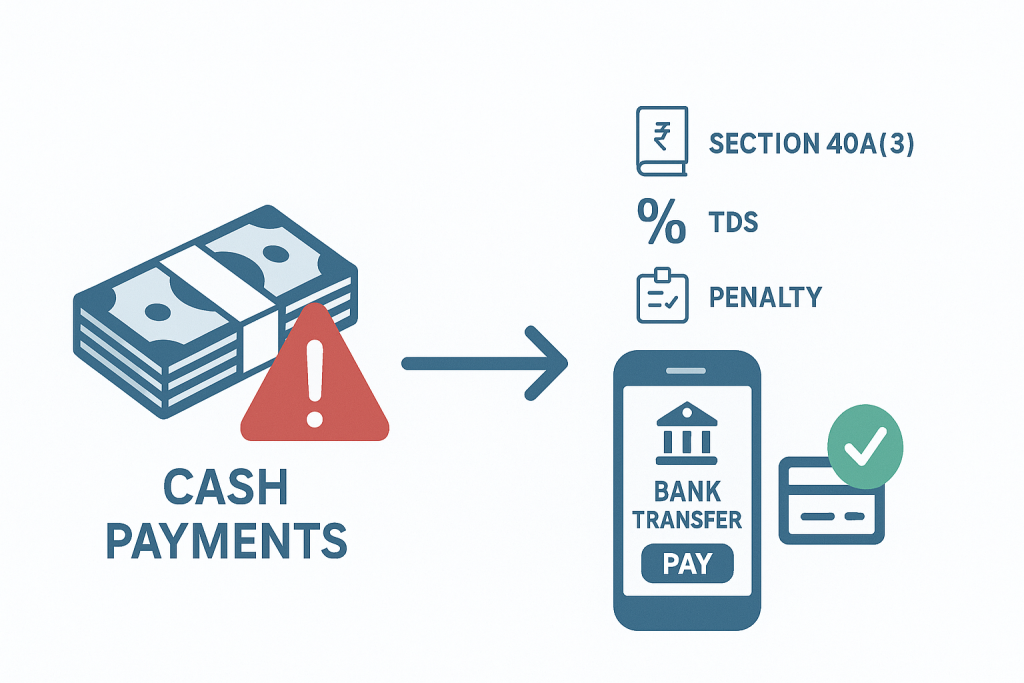

2. Cash Payments and Non-Compliance with Income Tax Law

This is a silent but serious red flag often ignored by founders.

The Income Tax Act disallows certain expenses paid in cash, even if they’re genuine.

Key Provisions to Remember

- Section 40A(3) — Any cash payment exceeding ₹10,000 to a single person in a day (other than exceptions) is not allowed as a business expense.

- Section 40(a)(ia) — Expenses paid without deducting TDS where applicable are partially or fully disallowed.

- Section 269ST — Receiving cash above ₹2,00,000 from a person in a day can attract penalty equal to the amount received.

Why It’s Dangerous

- Disallowance of expenses inflates your taxable income.

- You end up paying higher taxes than necessary.

- Repeated violations can attract scrutiny and penalty under Income Tax.

- Reflects poor internal controls — a red flag for investors and auditors.

How to Fix:

- Avoid cash payments — always use banking channels.

- Deduct and deposit TDS on time for all eligible expenses.

- Keep digital records and proper invoices for all transactions.

- Conduct a quarterly TDS and expense compliance review.

Digital, traceable payments ensure expense legitimacy and smooth audits.

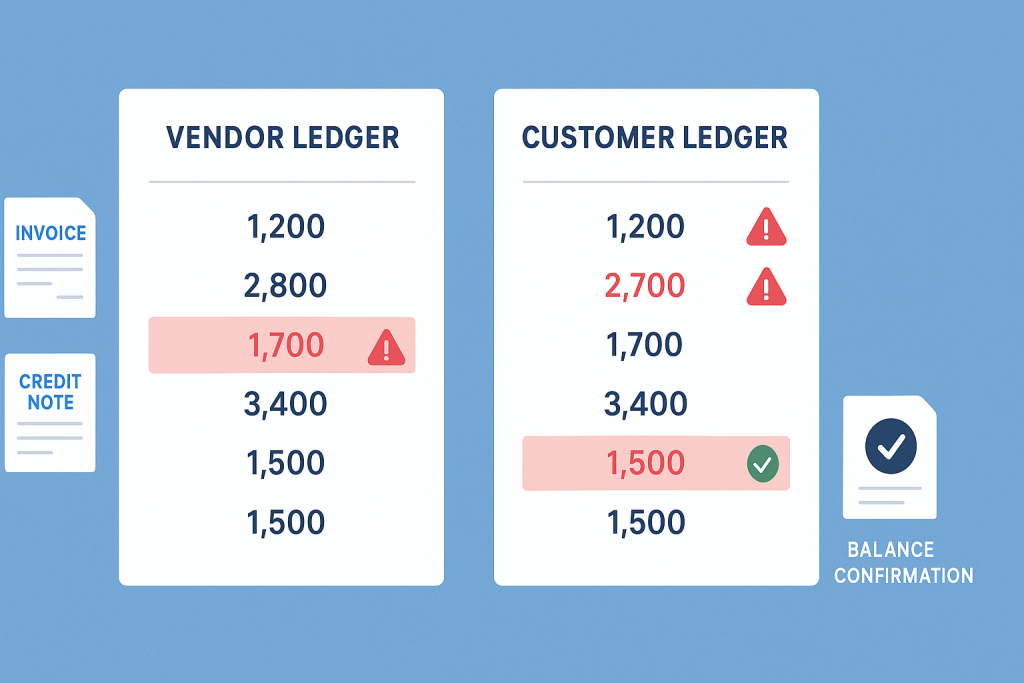

3. Delayed Vendor and Customer Reconciliation

When your accounts payable and receivable ledgers don’t match with your vendors or clients, it’s a serious red flag.

Why This Happens:

- Vendor invoices received late or recorded in the wrong period.

- Advance payments not adjusted properly.

- Credit notes/debit notes missed.

- Lack of monthly confirmation of balances.

Why It Matters:

Unreconciled accounts lead to:

- Overstatement or understatement of expenses and income.

- Disputes with vendors or clients.

- Delay in closing books or filing returns.

- Wrong picture of working capital and profitability.

How to Fix:

- Perform vendor and debtor reconciliation at least quarterly.

- Send balance confirmation statements before finalizing financials.

- Record all advances and credit notes promptly.

- Use automation tools or your accounting software’s reconciliation module.

- Review ageing reports monthly — outstanding beyond 90 days should always be investigated.

Founders who review their Top 10 Debtors and Creditors every month rarely face liquidity shocks.

4. Poor Cash Flow Planning

Many profitable businesses fail due to one reason — cash crunch.

Profitability and liquidity are not the same. You can show profit on paper but still struggle to pay vendors, salaries, or taxes.

Why This Happens:

- No proper cash flow forecasting.

- Too much credit extended to customers.

- Stock tied up in slow-moving inventory.

- Unplanned capital expenditure.

- Irregular follow-up on receivables.

Why It Matters:

- Missed vendor or tax payments cause interest and late fees.

- Relationships with suppliers or employees get strained.

- Emergency loans increase cost of capital.

- Business growth opportunities are missed due to fund shortages.

How To Fix:

- Prepare a weekly or monthly cash flow forecast.

- Track collections daily — ensure clear credit policies.

- Schedule vendor payments strategically based on priority.

- Monitor working capital ratios like Debtors Days, Inventory Turnover, and Creditors Days.

- Involve your CFO service provider to help you balance liquidity and profitability.

A well-managed cash flow ensures business growth without stress.

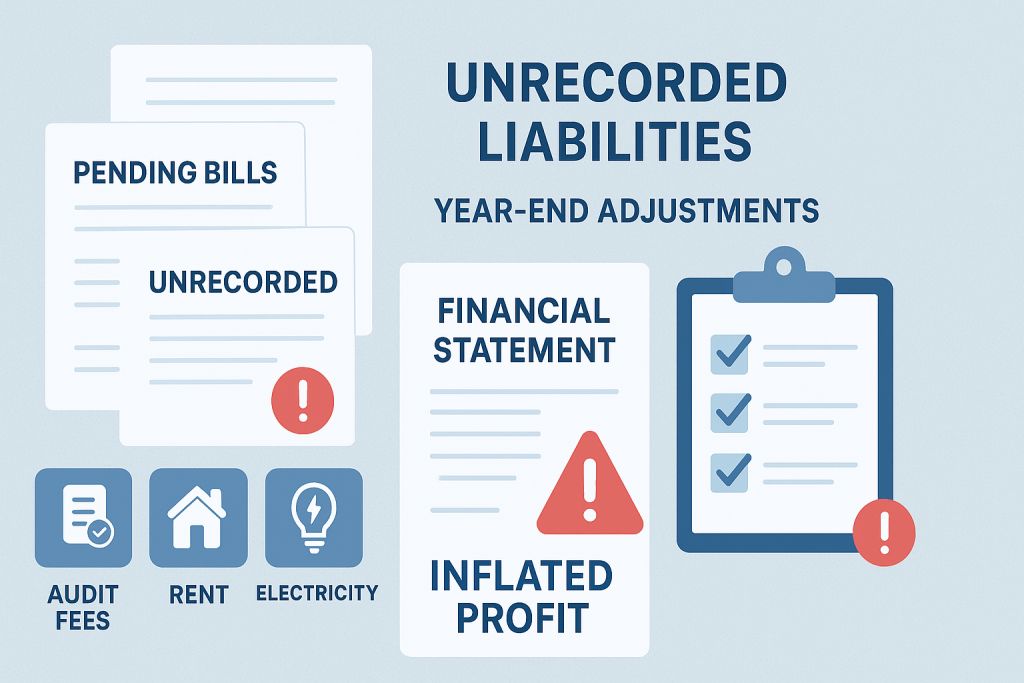

5. Unrecorded Liabilities and Year-End Adjustments

Another hidden red flag is unrecorded liabilities — expenses or obligations incurred but not booked in accounts.

Why This Happens:

- Expenses booked only on payment, not accrual basis.

- Year-end provisions not made (audit fees, electricity, rent, etc.).

- GST or TDS not properly accrued at year-end.

- Lack of communication between accounts and operations.

Why It Matters:

- Your financials show inflated profit.

- Tax liability becomes inaccurate.

- Statutory audit observations increase.

- Future period gets burdened with old expenses.

How to Fix:

- Maintain a monthly closing checklist for recurring expenses.

- Ensure all unpaid bills are recorded at month-end.

- Make provisions for expected expenses before closing books.

- Review “unpaid bills” and “unadjusted advances” regularly.

Conclusion: Clean Accounts = Confident Decisions

.As a founder, you don’t have to be an accountant — but you must ensure your financial foundation is strong.

By keeping an eye on these 5 red flags, you can prevent compliance issues, improve cash flow, and make faster, data-driven decisions.

Remember, your accounts are not just for filing returns — they’re your business’s mirror.

The clearer the mirror, the better your decisions.

Partner With Experts Who Keep Your Accounts Healthy

At Vizttax, we act as your Finance Partner, not just your accountants.

Our CFO Services ensure:

- Monthly review of accounts and GST reconciliation

- Vendor & customer reconciliations

- MIS and profitability analysis

- Cash flow monitoring and business planning

- Compliance accuracy across GST, Income Tax, and TDS

Let’s turn your accounts into your strongest business asset.

Let’s build a financial control system that helps your business grow smarter every month.

Visit www.vizttax.com