Startup India Seed Fund Scheme (SISFS): Legal Framework, Funding Structure & Practical Insights for Early-Stage Startups

Introduction: Why Seed Funding Needs Government Intervention

In India’s startup ecosystem, the most fragile phase is not expansion or scaling — it is ideation and validation. At this stage, startups have innovation, intent, and capability, but lack risk capital.

Traditional lenders avoid unproven models. Angel investors expect early traction. Venture capital waits for revenue visibility. This creates a funding vacuum at the seed stage.

To address this structural gap, the Government of India introduced the Startup India Seed Fund Scheme (SISFS) — a targeted policy intervention aimed at converting ideas into investible startups.

Legal & Policy Background of SISFS

Statutory Authority

The scheme is launched and governed by:

- Department for Promotion of Industry and Internal Trade (DPIIT)

- Ministry of Commerce & Industry, Government of India

Governing Document

- Startup India Seed Fund Scheme (SISFS) Guidelines, 2021

- Approved by the Empowered Committee constituted by DPIIT

- Implemented through Startup India platform

The scheme operates under executive policy powers of the Central Government and does not require separate legislation, similar to other startup incentive schemes.

Objective of Startup India Seed Fund Scheme

As per official guidelines, the objectives are to:

Provide financial assistance to startups at early stages

Enable Proof of Concept (PoC), prototype development, and market entry

Reduce dependency on informal funding or premature equity dilution

Promote innovation-led entrepreneurship across India, including Tier-2 and Tier-3 cities

Who Can Apply Under SISFS? (Eligibility Conditions)

As per Clause 6 of SISFS Guidelines, a startup must satisfy all of the following:

1. DPIIT Recognition (Mandatory)

- Startup must be recognised under Section 2(92) of the Companies Act, 2013 read with DPIIT notification

- Recognition through Startup India portal

2. Age of Startup

- Incorporated not more than 2 years at the time of application

3. Startup must not have received:

Startup must:

- Be innovation-driven

- Use technology or scalable business model

- Have potential for employment generation or wealth creation

4. Nature of Business

Startup must not have received:

- More than ₹10 lakh as monetary support from any Central or State Government scheme, excluding:

- Prize money

- Hackathon grants

- Prototype challenge awards

This ensures SISFS supports first-time seed-stage startups only.

Funding Structure Under SISFS

The scheme provides two distinct forms of financial support, each governed by separate conditions.

1. Grant Support – Up to ₹20 Lakhs

Legal Basis

- Clause 8(a) of SISFS Guidelines

Purpose of Grant

Grant funding can be used for:

- Proof of Concept (PoC)

- Prototype development

- Product testing and trials

- Market validation

- MVP development

Key Conditions

- Disbursed only through selected incubators

- Released in milestone-based tranches

- No equity dilution

- Grant cannot be used for:

- Office rent (except incubator facilities)

- Founder salary beyond approved norms

- Marketing at scale

This funding is non-repayable, subject to milestone compliance.

2. Investment Support – Up to ₹50 Lakhs

Legal Basis

- Clause 8(b) of SISFS Guidelines

Mode of Investment

Provided through:

- Convertible debentures

- Debt

- Debt-linked instruments

Purpose

- Commercialisation

- Market entry

- Early scaling

- Working capital for validated products

Key Features

- Investment decision taken by incubator’s Investment Committee

- Valuation aligned with market norms

- Startup can receive:

- Grant once

- Investment once

- Or both (subject to approval)

This ensures capital discipline while keeping founders protected from early dilution.

Role of Incubators Under SISFS (Critical Governance Layer)

Unlike many schemes, funds are not directly released to startups.

Incubators are:

- Selected by DPIIT through a competitive process

- Registered legal entities (Section 8 companies, trusts, societies, universities, etc.)

Responsibilities of Incubators

As per Clause 7:

- Evaluate startup applications

- Conduct presentations & due diligence

- Disburse funds

- Monitor milestones

- Provide:

- Mentorship

- Legal & compliance guidance

- Investor access

- Ecosystem support

This structure ensures accountability, governance, and business mentoring, not just funding.

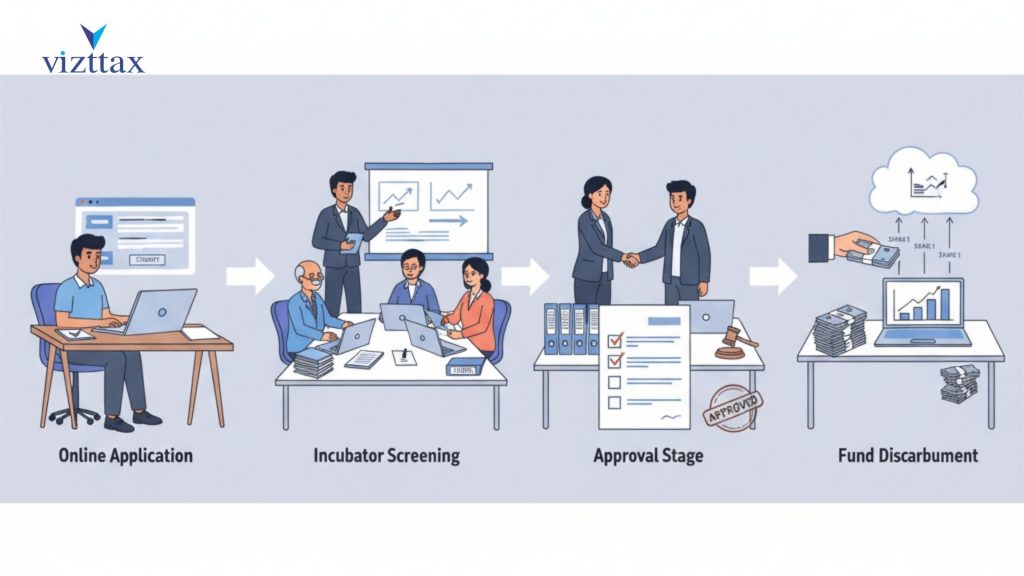

Application Process (Step-by-Step)

Step 1: Online Application

- Apply through Startup India Seed Fund portal

- Choose up to 3 incubators

Step 2: Incubator Screening

- Document review

- Pitch presentation

- Technical & commercial evaluation

Step 3: Approval & Agreement

- Execution of grant/investment agreement

- Milestone definition

Step 4: Fund Disbursement

- Released in tranches

- Subject to milestone achievement

Sector Coverage

SISFS is sector-agnostic, covering:

- AgriTech

- HealthTech

- FinTech

- EdTech

- CleanTech

- BioTech

- Manufacturing

- Social Impact

- Deep Tech & SaaS

Compliance & Reporting Obligations

Startups must:

- Maintain proper books of accounts

- Submit milestone utilization reports

- Allow audit / review by incubator or DPIIT if required

- Use funds strictly as per approved purpose

Misutilisation can lead to termination and recovery.

Why SISFS is a Strategic Policy Intervention

- Reduces early-stage funding failure

- Encourages innovation beyond metro cities

- Strengthens incubator-led ecosystems

- Aligns with Atmanirbhar Bharat & Startup India vision

- Creates a pipeline of VC-ready startups

Conclusion

India cannot build global startups only by funding growth — it must fund belief.

The Startup India Seed Fund Scheme does exactly that by backing innovation before traction, and vision before valuation.

For early-stage founders, SISFS is not merely a scheme — it is a launchpad into the formal startup ecosystem.

Frequently Asked Questions (FAQs) – Startup India Seed Fund Scheme (SISFS)

1. Is SISFS funding given directly by the Government to startups?

No. Funds are not disbursed directly by the Government. As per SISFS Guidelines, funding is routed only through DPIIT-approved incubators, which evaluate, disburse, and monitor the startups.

2. Can a startup receive both grant and investment support under SISFS?

Yes. A startup can receive:

- Grant support once (up to ₹20 lakhs), and

- Investment support once (up to ₹50 lakhs) subject to eligibility, milestones, and incubator approval.

3. Does SISFS require equity dilution at the grant stage?

No. Grant support does not involve equity dilution. Equity or quasi-equity instruments are applicable only in the investment support phase.

4. Is DPIIT recognition mandatory to apply for SISFS?

Yes. DPIIT recognition is compulsory. Startups not recognised under Startup India are not eligible to apply under SISFS.

5. Can LLPs apply for Startup India Seed Fund Scheme?

Yes. Private Limited Companies and LLPs recognised by DPIIT are eligible, provided all other scheme conditions are fulfilled.

6. Can a startup apply to more than one incubator?

Yes. A startup can select up to three incubators while applying on the Seed Fund portal.

7. Is there any sector restriction under SISFS?

No. SISFS is sector-agnostic, covering technology, manufacturing, services, social impact, and innovation-driven startups.

8. What happens if milestones are not achieved?

Failure to meet milestones may result in:

- Delay or stoppage of further disbursement

- Termination of support

- Recovery proceedings in case of misuse

9. Is professional assistance required for SISFS application?

While not mandatory, professional support significantly improves approval chances, especially in:

- Pitch documentation

- Financial projections

- Compliance alignment

- Incubator presentation strategy

Need Expert Assistance for SISFS Application & Fund Structuring?

At Vizttax CFO Advisory, we assist early-stage startups in end-to-end SISFS compliance and execution, ensuring your idea is presented in a fundable, compliant, and scalable manner.

Our SISFS Advisory Covers:

- DPIIT recognition support

- Incubator shortlisting & strategy

- Application drafting & documentation

- Pitch deck & financial projections

- Grant & investment agreement review

- Post-fund compliance & milestone reporting

- CFO-level advisory for fund utilisation

We focus on capital efficiency, compliance, and investor readiness, not just application filing. Get in touch with Vizttax to convert your idea into an investible startup under Startup India Seed Fund Scheme.