A Comprehensive Guide by Vizttax on New Labour Codes (2025): – Your Trusted Compliance Partner

Every successful business owner today — whether they run a tech startup, a manufacturing firm, or a trading company — has one thing in common: a strong Monthly MIS (Management Information System).

The new Labour Codes aim to strengthen worker protection, reduce compliance burden, ensure nationwide uniformity, and align India’s labour ecosystem with global standards.

At Vizttax, we help businesses understand these changes and implement them smoothly.

1. Background – Why These Reforms Were Needed

Most of India’s labour laws were enacted between the 1930s and 1950s. Over time, these laws became fragmented, overlapping, and outdated for today’s business environment.

Challenges included:

- Multiple registrations and returns

- Ambiguity between central and state laws

- Limited social security coverage

- Inefficient dispute resolution

- Excessive paperwork and inspections

The new Labour Codes resolve these challenges by creating a uniform, simplified, and technology-driven framework.

2. Overview of the Four Labour Codes

Covers minimum wages, payment of wages, bonuses, and floor wage norms.

b) Industrial Relations (IR) Code, 2020

Covers trade unions, retrenchment rules, layoffs, closures, and dispute resolution.

c) Code on Social Security, 2020

Covers PF, ESIC, gratuity, maternity benefits, employee compensation, unorganised workers, gig and platform workers.

d) OSH & Working Conditions Code, 2020

Covers safety standards, working hours, welfare facilities, and workplace conditions.

3. Key Changes Introduced Under the New Labour Codes

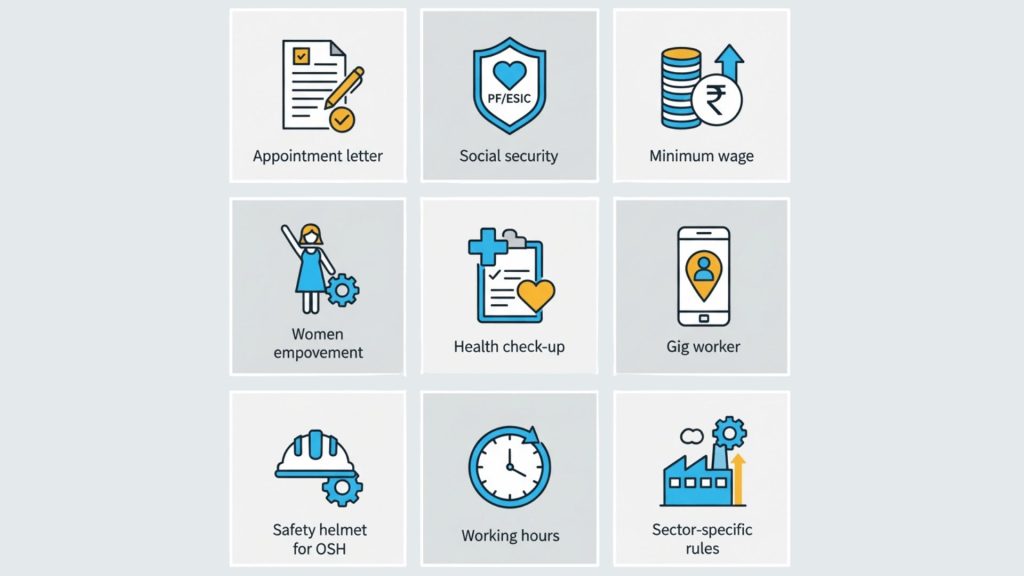

Here is a detailed look at the most important reforms, explained simply and practically:

3.1 Mandatory Appointment Letters for All Workers

Every worker—permanent, temporary, fixed-term, contract, gig or platform—must receive a formal written appointment letter.

Impact:

- Ensures transparency

- Provides proof of employment

- Reduces disputes

3.2 Universal Social Security Coverage

The new framework significantly expands social security benefits.

Key Provisions:

- PF & ESIC now cover almost all workers, including gig and platform workers.

- ESIC now available PAN-India, including rural and non-notified areas.

- Mandatory ESIC if even one worker is employed in hazardous processes.

- Aadhaar-linked UAN ensures portability across states.

Impact on Employers:

Organisations must update payroll, registrations, and internal systems to reflect wider coverage.

3.3 Minimum Wages for All Workers

Earlier, minimum wages applied only to scheduled industries. Now, every establishment must follow minimum wage rules.

Additional requirement:

Central Government will fix a National Floor Wage—no state can set wages below this.

3.4 Timely Payment of Wages

Employers must make timely wage disbursal, with clearly defined timelines.

No unauthorised wage deductions are allowed.

3.5 Women Empowerment Measures

The new Codes strengthen gender equality with the following:

- Women can work night shifts in all sectors, including mining and hazardous processes, with consent and safety measures.

- Equal pay for equal work is mandatory.

- Mandatory representation of women in grievance committees.

- In maternity benefits, definition of “family” expanded to include parents-in-law.

3.6 Fixed-Term Employment (FTE) Reforms

Fixed-term employees get full benefits:

- Paid leave

- Medical insurance

- Equal wages

- Gratuity after 1 year (instead of 5 years)

This promotes direct hiring and reduces excessive contractualisation.

3.7 Gig & Platform Workers Included for the First Time

One of the most significant reforms:

- Gig and platform workers defined legally

- Aggregators must contribute 1–2% of annual turnover toward their welfare fund

- Cap: max 5% contribution of the amount payable to gig workers

This introduces formal protection for workers engaged via apps/platforms.

3.8 Standardised Working Hours and Overtime

New norms include:

- 8–12 hours per day

- Maximum 48 hours per week

- Mandatory overtime at double wages

- Overtime only with the worker’s consent

3.9 Free Annual Health Check-Up

Workers aged above 40 must receive free yearly health check-ups from the employer.

3.10 Simplified Compliance Framework

To remove complexity and harassment

- Single registration

- Single license

- Single return across labour laws

- Overtime only with the worker’s consent

- Digital maintenance of registers

- Risk-based inspections

- Inspector converted to Inspector-cum-Facilitator

This significantly reduces compliance burden.

3.11 Strengthened Workplace Safety (OSH Code)

Major welfare improvements:

- Mandatory safety committees (establishments with 500+ workers)

- Safety officers in factories/mines

- National OSH standards

- Adequate drinking water, sanitation, rest rooms, first aid

- Mandatory PPE and accident prevention standards

- Strict compliance for hazardous industries

3.12 Sector-Specific Benefits

The Codes introduce tailored provisions for:

- IT & ITES

- Textiles

- Mines

- Dock work

- Beedi & Cigar

- Plantations

- Export industry

- Audio-visual & media workers

Each sector receives improved safety, wage norms, overtime rules, and social security eligibility.

4. Impact on Employers & HR/Compliance Teams

Organisations will need to:

- Update HR policies and employee handbooks

- Revise appointment letters and contract templates

- Realign wage structure with the revised “wage” definition

- Update payroll systems for PF/ESIC coverage

- Draft new standing orders (where applicable)

- Prepare for digital registers and filings

- Review contractor agreements

- Strengthen workplace safety systems

- Implement shift and working hours changes

Failure to comply may lead to penalties, litigation, and inspection issues.

5. How Vizttax Helps You Comply Seamlessly

At Vizttax, we support businesses across India with:

- Labour Code implementation advisory

- Payroll restructuring as per new wage definition

- Drafting/updating HR & employment documents

- Contractor compliance review

- PF/ESIC registration and transition support

- Standing orders & IR compliance

- Safety standards compliance

- End-to-end labour law & HR audits

We ensure your organisation becomes fully compliant without disruption.

6. Final View: A Balanced and Forward-Looking Reform

The new Labour Codes mark India’s biggest labour law reform in decades.

They provide:

- Better worker protection

- Wider social security net

- Simplified compliance for employers

- Gender inclusion

- Support for gig, migrant & MSME workforce

- Improved workplace safety

- Faster dispute resolution

These changes create a more transparent and business-friendly environment while strengthening worker welfare.

Need Assistance With Labour Code Compliance?

Our team at Vizttax is ready to help your organisation implement these reforms smoothly.

Email: info@vizttax.com | Website: www.vizttax.com | Based in Delhi | Serving Clients Pan-India